If you’re looking at selling, feel free to reach out and ask about a “Competitive Market Analysis” or CMA. With the quickening of the market, there’s not a better time to list. Your biggest question will be, did you pick the best agent to market for you? And we’re confident that we can help you answer that question with an emphatic “YES”.

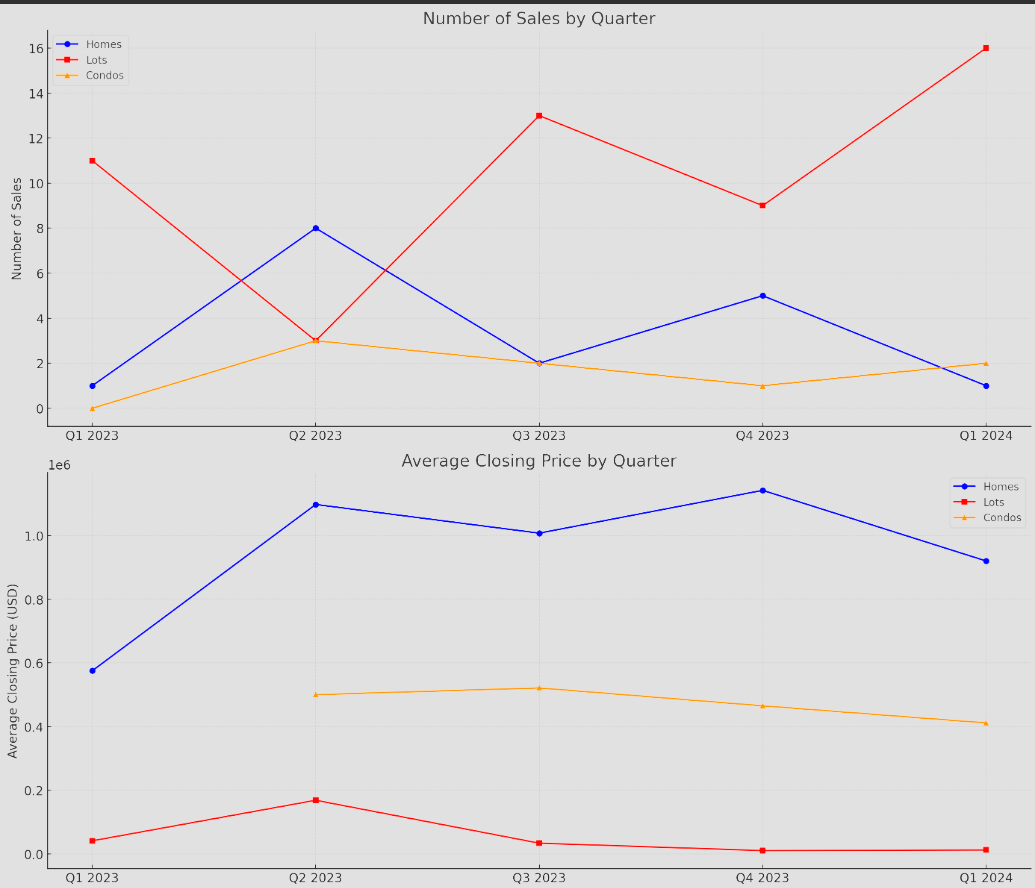

Who’s Moving In The Cliffs?

Possum Kingdom Real Estate continues to set the pace for sales in The Cliffs. Of the 20 sales that have taken place this past quarter, Matthew Renfro has represented 8 Sellers and is also credited with 8 of buyers sides as well. Additionally, Lars Hanssen and Jonathan Fowler are also credited with selling 1 of the condos from this quarter as well.

Written by Matthew Renfro with the aid of artificial intelligence.

All photography done by Matthew Renfro and is not for use beyond this website without his expressed approval.